Edinburgh Waterfront in the British Virgin Islands

The Guardian are running a series of investigative articles on the use of offshore tax havens to acquire land & property in London. It was timely, therefore to see Steven Vaas’s article in the Herald on Monday which revealed that seven parcels of land at Granton Harbour and Western Harbour – part of the Waterfront development – in Edinburgh have been sold to a company called Sapphire Land Ltd., PO Box 957, Offshore Incorporations Centre, Road Town, Tortola, BRITiSH VIRGIN ISLANDS.

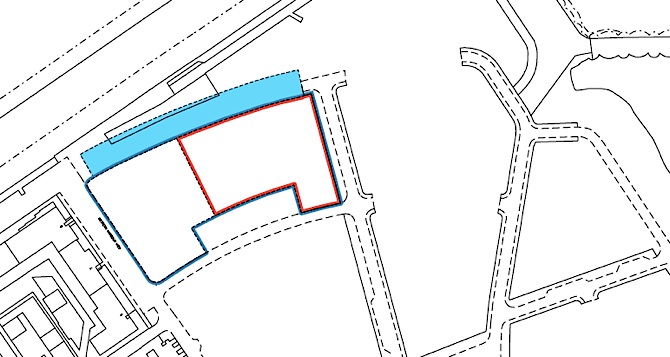

One parcel alone, (pictured below) was bought by FM Homes Ltd in January 2008 for £3,075,000 and sold to Sapphire for £327,916 in August 2012.

This sale of land adds to a growing list of land and property in Edinburgh and across Scotland including much of Charlotte Square which is now owned by companies operating out of offshore tax havens.

I argued during the passage of the Land Registration (Scotland) Bill that we need to make sure that there is transparency in landownership. The simple legal answer is that there is. After all, I have just consulted the Registers of Scotland and note that this land is owned by Sapphire Land Ltd. – what more do I need to know? But this analysis goes to the heart of the debate over the Bill which was regarded as merely a legalistic reform by the Scottish Government and arguments from myself and others that it should be seen as part of a wider public land information system were rejected by Ministers.

In my 4th blog on the Bill (click on “Land Registration” category on right side for all of them), I cited the growing evidence that registering land in tax havens frustrates the administration of the criminal law, the collection of taxes, and good governance by concealing the true beneficial owners of land. Specifically, my proposal for transparency on offshore landownership was rejected (despite having been called for by the SNP when in opposition). My written evidence is here.

There are now over 750,000 acres of land in Scotland owned by companies in offshore tax havens. We know nothing about who is behind these companies and they are probably avoiding a lot of tax. Why, oh why does the Scottish Parliament not feel able to do the simple things it can to make Scotland a fairer and more equitable society? What possible public benefit can there be in allowing the public registration of land in the name of companies located in tax havens?

Anyone?

Am I right in understanding the figures there?

FM Homes have sold this land at a loss of £2,747,084 after holding it for 4 years?

So showing a loss on their books and therefore not paying any tax?

How can it be that simple?

FM Homes Ltd went into administration 23 February 2009.

If all the big companies are acting in this way…avoiding tax but actually demanding quite a voice in public discussion generally…if Scotland starts cracking down on land held in this way…I wonder if Scottish politicians are scared of seeming like the generation who drove international mobile capital away from Scotland.

Of course there is the complete nonsense of how our big estates bring in so much money into the local economy…I live near one and I see no difference whatsoever. I know your work is dedicated to showing how Scotland’s landowning came about but the international model of doing business as it has slowly changed over the last thirty years has stopped anyone being able to challenge anything. The consensus is too ingrained. I mean…it’s a scandal how small the union voice is in the national media but they actually represent more people by one order of magnitude than support the main political parties.

So…to answer your question…offshoring of companies who own land offers no benefits but our politicians who generally lack any real-world experience have no courage and seem to enjoy rubbing shoulders with the wealthy whilst in power and joining their companies when they lose power. That’s a nice cosy thought as the nights draw in….

This land has now rewilded and is home to lots of birds, insects, breeding swans etc. FM homes have resurrected themselves under a new name and are trying to get permission to rip up this green space for a mass building project. There is currently a campaign underway to fight this and save the green space.