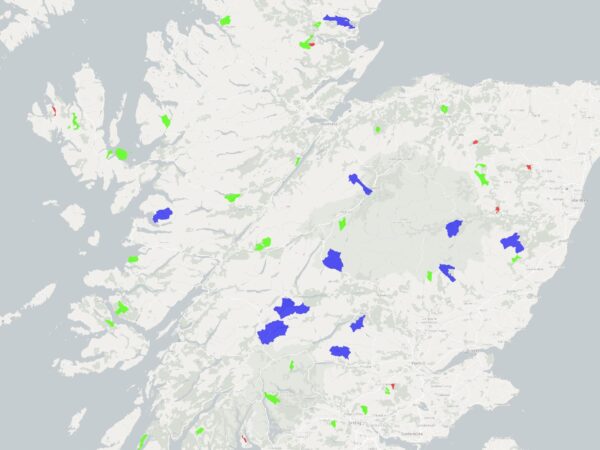

Not Revealed – 239,000 ha of offshore ownership.

As part of the efforts of Governments across the UK, the Register of Persons Holding a Controlled Interest in Land (RCI) was established in Scotland as part of the Land Reform (Scotland) Act 2016 and implemented by The Land Reform

Continue reading